When Finance Minister and Deputy Prime Minister Lawrence Wong said that this year’s budget would be his Valentine’s Day gift for us, he wasn’t joking.

For a start, we’d have thought that for 2022, Singapore would no longer be “losing money” as we’ve reopened, but it turned out that for FY2022, we’re still “losing” $2 billion.

Despite that, things are improving…but I’m sure you’re not here to read about how the Government is going to navigate around this tricky problem.

Instead, you’re wondering what Valentine’s Day gift you’re getting.

Here are five things announced in Budget 2023 that’ll affect you.

(Of course, this has to be passed in Parliament, but come on.)

More Money Given to Singaporeans

Every year, we’d get GST Vouchers to offset the GST. You can watch this video to learn more (note: It’s to offset GST, not to offset the GST hike):

Last year, DPM Wong has increased the amount, and this will be increased even more.

For most of us, the GST Cash Voucher amount will increase from $500 to $700 in 2023, and to $850 from 2024 onwards. There would be increase in non-cash rebates, too.

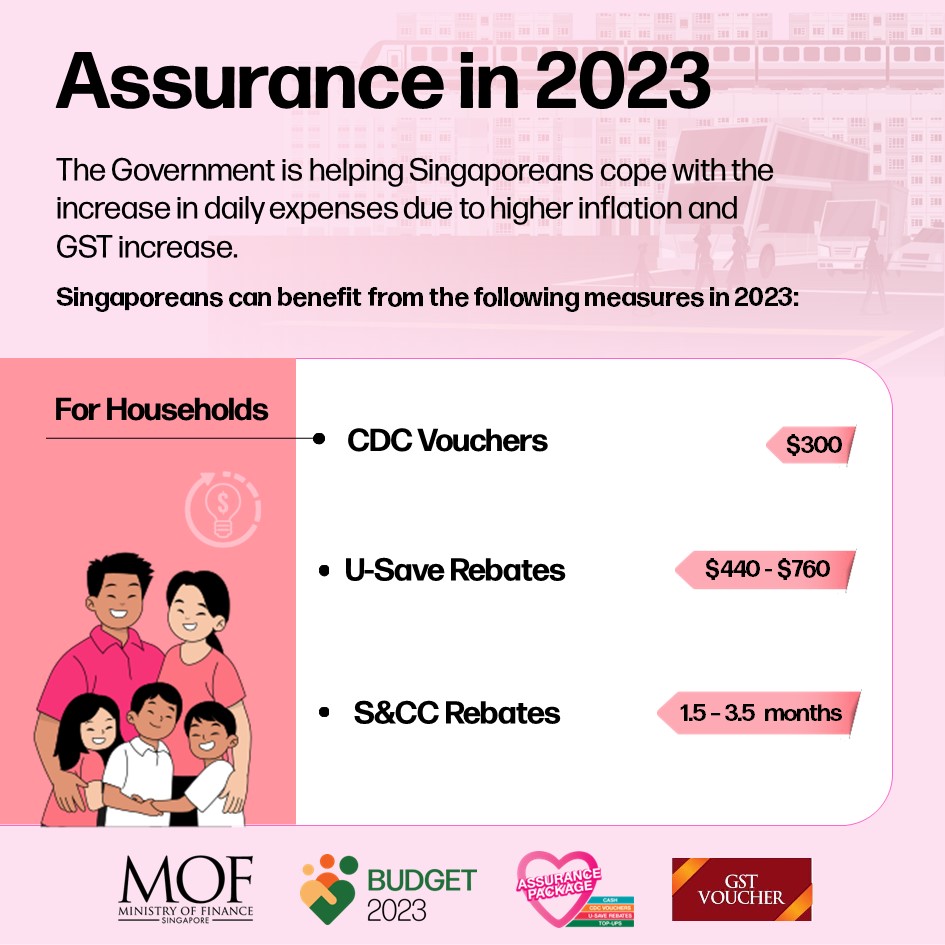

In addition, the Assurance Package (this is the one that’s to offset the GST hike) will also increase. The amount would depend on your annual income.

Also, the CDC vouchers will be raised by $100 for everyone.

Simply put, these are the cash you’d expect to receive this year (do note it depends on your annual income):

June 2023: Up to $400 cash (Cost-Of-Living Special Payment aka fight inflation one lah)

August 2023: Up to $700 cash (Annual GST voucher)

December 2023: Up to $600 cash (Assurance Package aka fight GST hike one lah)

January 2024: $300 CDC vouchers

You might want to follow us on Telegram or Instagram to know more about any of the payouts as we’ll publish articles about them closer to the payout date.

First Timer Applicants for BTO or Resale Flats to Have More Benefits

If you’re applying BTO for the first time as a family with a kid, you’d be placed in a special category that’ll give you an additional BTO ballot, so you’d have a higher chance to get one.

If you’re a family buying a resale HDB flat, there are benefits for you, too: first-timer families buying four-room or smaller resale flats will be increased by $30,000, and the grant for those buying five-room or larger flats will also be increased by $10,000.

Good Time to Have Babies

From today, Baby Bonus cash gift for all eligible Singaporean children will increase by $3,000, which means the first and second children will receive $11,000 instead of $8,000. For the third child, it’ll increase from $10,000 to $13,000.

However, do note that they will be paid out over a longer period. Instead of payouts in five instalments in the first 18 months, parents will get up to $9,000 in the first 18 months, and the remaining until the kid is six and a half years old.

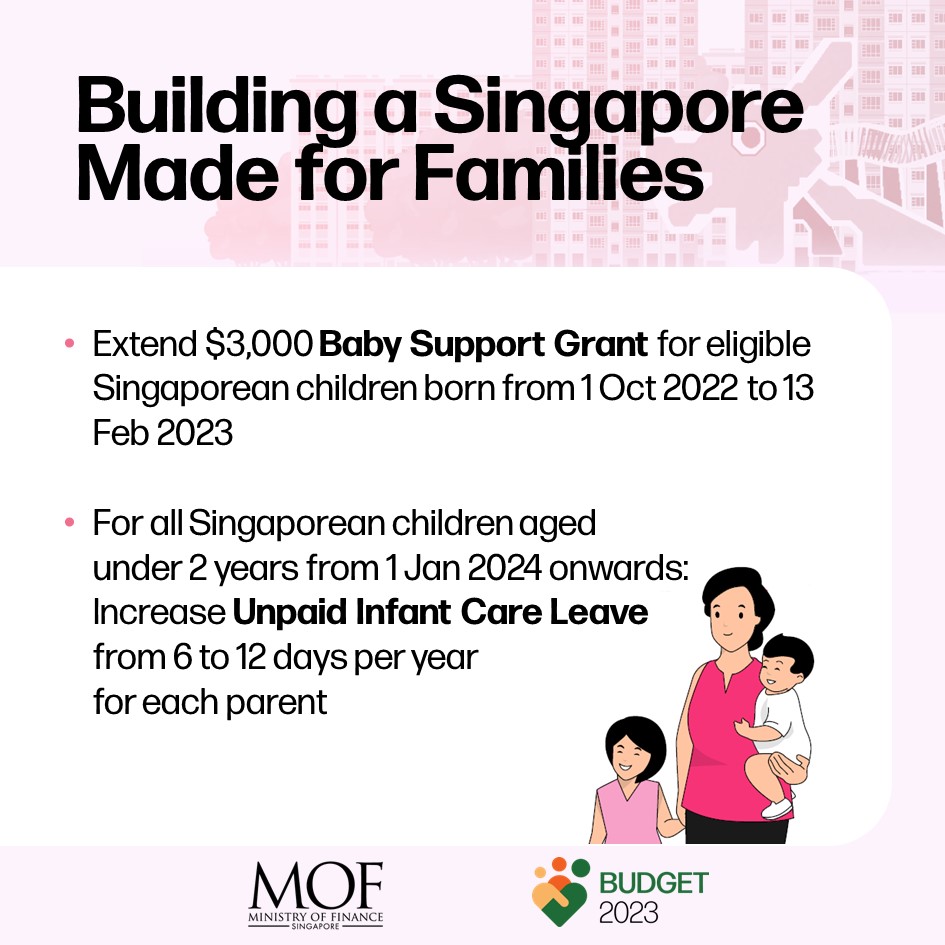

In addition, the one-off Baby Support Grant of $3,000 to babies will be extended to babies born before from 13 Feb 2023. This was supposed to end on 30 September 2022.

For Singaporean babies born after 1 January 2024, government-paid paternity leave will be doubled from two weeks to four weeks for eligible working fathers.

From 1 January 2024, unpaid infant care leave for each parent in their child’s first two years will be doubled to 12 days per year (previously was 6 days per year).

Simply put, new parents should be very happy today.

Changes to CPF

Well, this might not affect you unless you earn over $6,000 a month.

Lest you’re not aware, if you earn over $6,000 a month, the CPF contribution will be capped and calculated at the $6,000 mark; this will be increased to $8,000 a month in 2026.

The change will occur progressively from September 2023.

You can watch this video to know more about CPF in Singapore:

Also, for platform workers (e.g. food delivery riders), they’ll need to contribute CPF soon…which is old news.

However, DPM Wong said that the government is aware that their take-home pay would be affected, so they’ll provide CPF transition support to lower-income platform workers.

Now, everything looks goody, right? With lots of freebies and support.

But where would the money come from?

Higher taxes, of course.

But don’t worry, it’s not another round of GST hike.

Worry if you’re smoker.

Higher Taxes for These “Items”

So summarise, here are some “products” with higher tax:

- Higher buyer’s stamp duty taxes for 15% of residential properties and 60% of non-residential properties in Singapore

- Higher taxes on tobacco products (i.e. cigarettes) from now on, which means your cigarettes are going to cost 15% more

- Higher taxes on super expensive cars, so if you’re just buying a Toyota, it shouldn’t affect you

In other words, two groups of people will be taxed more:

- Rich people

- Smokers

Now is the best time to quit smoking, eh?

Featured Image: YouTube (CNA)