Scammers are now helping scam victims by claiming to help scam victims recover money lost in scams to other scammers.

Reader: What? Scam… scam what?

Scams are no longer as simple as your sibling giving you the smaller half when you split something or when you put money into a vending machine and your snack gets stuck, leaving you empty-handed and $2 poorer.

Nowadays, there are so many different scams popular in Singapore that can rob you of thousands and thousands of dollars.

Even the people who claim to help you recover money you lost from scams can scam you.

Recovery Service Scams

Since the start of 2024, victims in at least 29 cases have fallen prey to fund recovery service scams that claim to offer assistance in recouping losses from previous fraudulent activities.

These victims have collectively lost more than $1.2 million, according to a police statement on 29 February.

These scammers typically impersonate legal firms or financial service companies and contact victims through calls, messages, or e-mails. They offer to help recover funds lost to scams or bad investments.

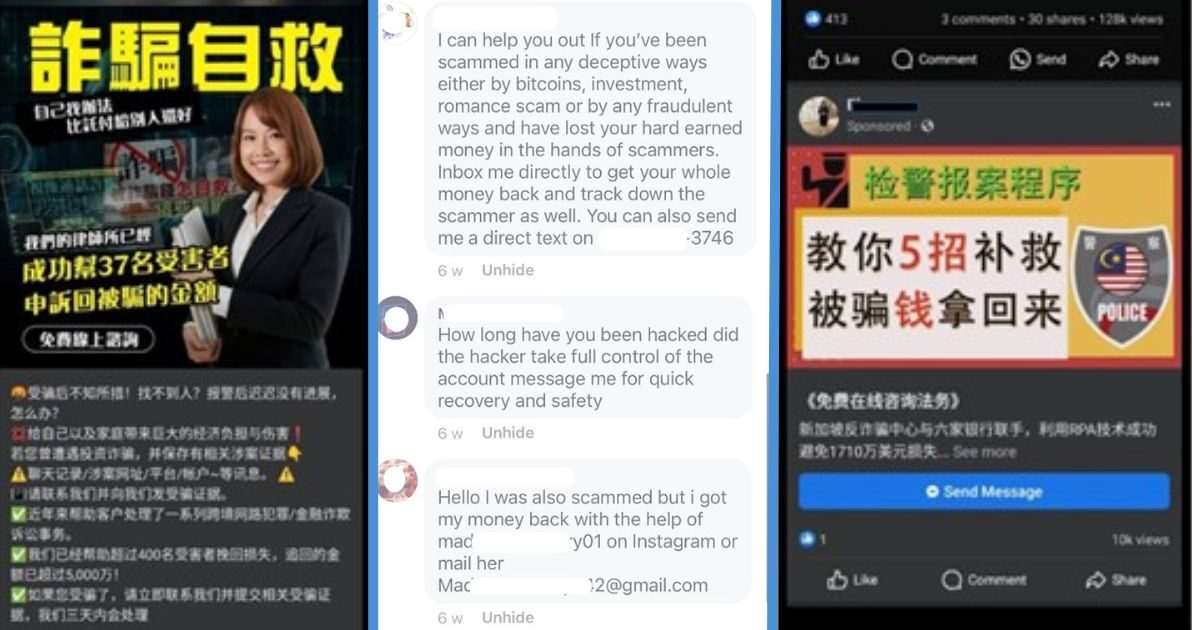

Some victims encountered these services advertised online, such as on Facebook, and contacted the scammers themselves.

Once contact was established, victims would be instructed to make upfront payments via bank transfers, cryptocurrencies, or virtual credits, claiming these as part of “administrative procedures”.

Some of these scammers also request victims’ banking credentials, debit/credit card details, or One-Time Passwords (OTPs) and use this information to access the victims’ bank accounts.

You should never share your OTP with anyone; your banking credentials and card details should also be kept private.

Some other scammers would ask victims to download remote access software such as AnyDesk, which allows the scammers to gain access to the victims’ devices and their bank accounts after the download.

Victims would subsequently realise that they had been scammed when their funds were not recovered as agreed, scammers became uncontactable, or when they checked with banks or the police through official channels.

Getting scammed once is already bad enough, getting scammed twice is really really so suey…

This type of scam is actually rather similar to another common scam in Singapore – malware scams. Malware scams managed to scam 1,899 victims of a total of $34.1 million in 2023. The police said the average amount lost per malware scam case was around $17,960.

Malware scams were the sixth most common scam in Singapore last year.

The police advises members of the public to be cautious when dealing with online services or websites offering to help recover funds lost to scams.

One can check if a law firm is registered with the Legal Services Regulatory Authority (LSRA) using the LSRA directory. If the advertised law firm is not registered, it is likely to be a scam.

“One time, two time ok, three time cannot.”

Sure, that may be the case for things like being late or forgetting homework, but when it comes to scams, one time cannot. Protect yourself so you don’t ever fall prey to scams even once.

The police encourages members of the public to adopt the following precautionary measures to safeguard against these scams

- Add the ScamShield App to protect yourself from scam calls and SMSes.

- Set security features such as transaction limits for internet banking transactons, enable Two-Factor Authentication (2FA), Multifactor Authentication for banks and e-wallets.

- Check for scam signs with official sources such as this site or call the Anti-Scam Helpline at 1800-722-6688).

- Avoid believing claims that they can help you to recover lost monies.

- Tell the authorities, family, and friends about scams. Report any fake comments or postings to the online platforms.

The most common scam in Singapore was job scams, which many of us should be familiar with. Plenty of us would have received “job offers”, which are actually scams on apps like WhatsApp and Telegram.

If you’re one of the few people who have not encountered this type of scam before, you can read this article to learn more about it, or watch this video to the end: