To most younger people, CPF doesn’t matter. Many younger people are probably upset that some of their salary goes into CPF, and it’s only when they want to buy a house that they realise how important CPF is.

Anyway, this article isn’t about younger people, because these changes in CPF will only be affecting our seniors.

If this CPF change does not concern you and you want to know about how Budget 2024 will affect you, read this article on 15 highlights of Budget 2024.

Increased CPF Contribution Rates

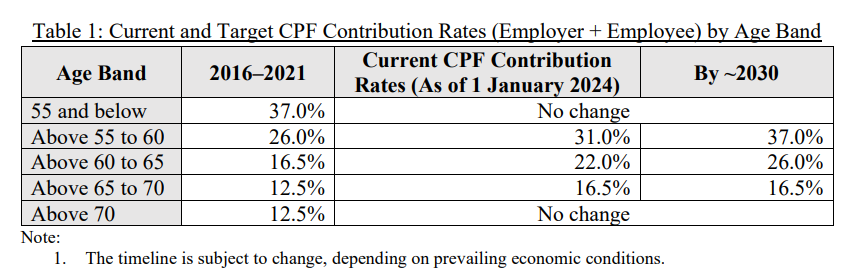

In line with recommendations from the Tripartite Workgroup on Older Workers in 2019, the Government announced gradual raises in CPF contribution rates over the next decade or so. This will apply to Singaporean and Permanent Resident workers aged above 55 to 70.

Once the increases have been fully implemented, members aged above 55 to 60 will have the same CPF contribution rates as younger workers.

Since 1 January 2022, the Government has been implementing increases in senior workers’ CPF contribution rates for workers aged above 55 to 70 each year. The target contribution rates for senior workers aged above 65 to 70 was reached this year.

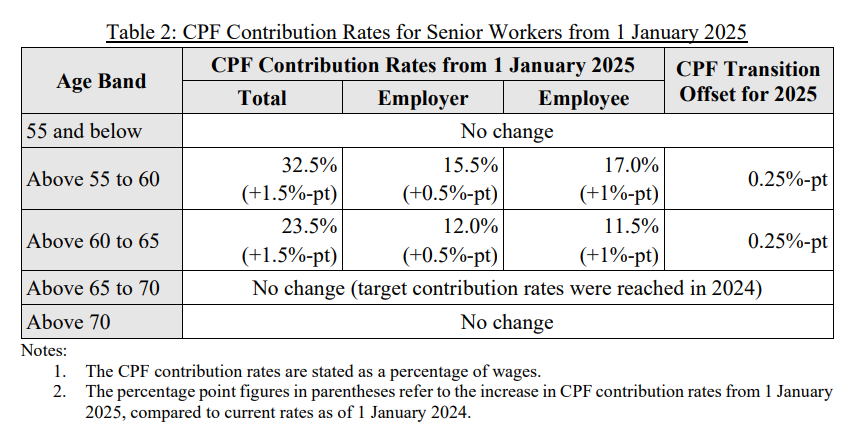

On 1 January next year, there will be a further increase in CPF contribution rates by 1.5 percentage points for workers aged above 55 to 60 as shown in the table below. This increase will be fully allocated to the CPF Special Account (SA) or Retirement Account (RA) to aid senior workers in saving for retirement.

Employers, don’t fret about rises in costs, the Government will be providing aid.

The Government will provide employers with a one-year CPF Transition Offset equivalent to half of the 2025 increase in employer CPF contribution rates for every Singaporean and Permanent Resident worker they employ aged above 55 to 65.

This will be provided automatically (applying for this is not necessary), and will mitigate the rise in business costs caused by this.

Increase in Enhanced Retirement Sum (ERS)

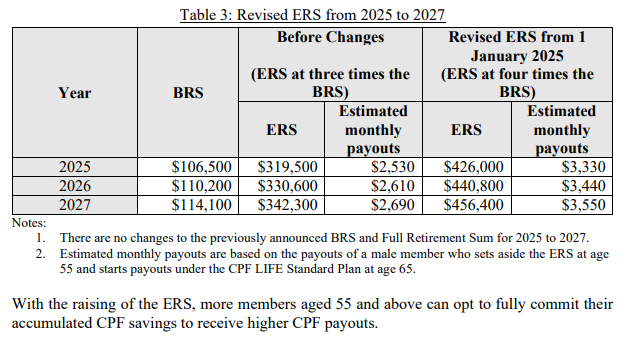

The ERS is the maximum amount of savings that CPF members aged 55 and above can place in their CPF Retirement Account (RA) to earn RA interest rates and receive CPF monthly payouts.

Currently, the ERS is set at three times the Basic Retirement Sum (BRS). From 1 January 2025, the ERS will be raised to four times the BRS. This means that the ERS next year will be $426,000.

Enhanced indeed.

This change will allow members to voluntarily top up more to their RA, by transferring their Ordinary Account savings or by making cash top-ups, in order to receive higher CPF monthly payouts in their retirement.

The ERS will also be increased to $440,800 and $456,000 in 2026 and 2027 respectively, further increasing monthly payouts.

Closure of the CPF Special Account (SA) for Members Aged 55 and Above

Currently, CPF members aged 55 and above own two CPF accounts that hold savings intended for retirement payouts – the CPF Special Account (SA) and the Retirement Account (RA).

Savings in both these accounts earn the same long-term interest rate, but some SA savings can be withdrawn on demand from age 55.

As a principle, long-term interest rates should only apply to savings that cannot be withdrawn on demand, while savings that can be withdrawn on demand should earn the short-term interest rate.

To better align CPF interest rates with the nature of CPF savings in each CPF account, the Government will close the SA for members aged 55 and above from early 2025.

SA savings will be transferred to the RA, up to the Full Retirement Sum (FRS), and will continue to earn the long-term interest rate.

Any remaining SA savings (that exceed the FRS) will be transferred to the Ordinary Account (OA). There, savings will remain withdrawable and will earn the short-term interest rate.

CPF members can choose to transfer their OA savings to their RA at any time, up to the Enhanced Retirement Sum (ERS). Once transferred to the RA, the monies will be committed towards higher retirement payouts and will earn higher interest.

Following the closure of the SA for members aged 55 and above early next year, all members will have three CPF accounts at any one time.

Members below the age of 55 will have the OA, SA, and MediSave Account.

Members aged 55 and above will have the OA, RA, and Medisave Account.

The MRSS was introduced in 2021 as a pilot.

Pilot as in initial short-term trial, not airplane pilot.

Under the current MRSS, the Government will match every dollar of cash top-up made to eligible CPF members aged 55 to 70, up to an annual cap of $600.

Anyone, including members’ families, employers, and the community, can make the top-ups to these eligible members’ CPF Retirement Account (RA).

Good news – the MRSS will be continuing beyond the current pilot with a few changes. From 1 January 2025, the age of eligibility will be expanded to include more members, and the matching grant cap will be increased.

From 1 January 2025 onwards, there will no longer be an age cap of 70 years old. CPF members aged 55 and above will be eligible for the MRSS.

The matching cap grant will be increased from the current $600 a year to $2,000 a year, with a $20,000 cap over an eligible member’s lifetime.

Yay, more money!

These changes aim to strengthen Singapore’s social compact as well as enable more seniors to meet their retirement needs.

Under the current MRSS, tax relief in the forms of CPF Cash Top-Up Relief is granted to some givers for cash top-ups that attract the MRSS matching grant. From 1 January next year, this tax relief will be removed as the matching grant is “already a significant benefit extended by the Government.”

Givers may continue to enjoy tax relief of up to $16,000 a year for eligible CPF cash top-ups that do not attract the MRSS matching grant.

These enhancements are expected the increase the number of CPF members eligible for MRSS from 395,000 in 2024 to 800,000 in 2025.