If you can remember anything before 2020, you’d probably recall that the government announced in Budget 2018 that there’d be a GST hike this year.

The hike – from 7% to 9% – was later put on hold due to the devastating economic impact of the COVID-19 pandemic.

We all quietly hoped that it’d be postponed forever, but, sadly, this won’t be the case.

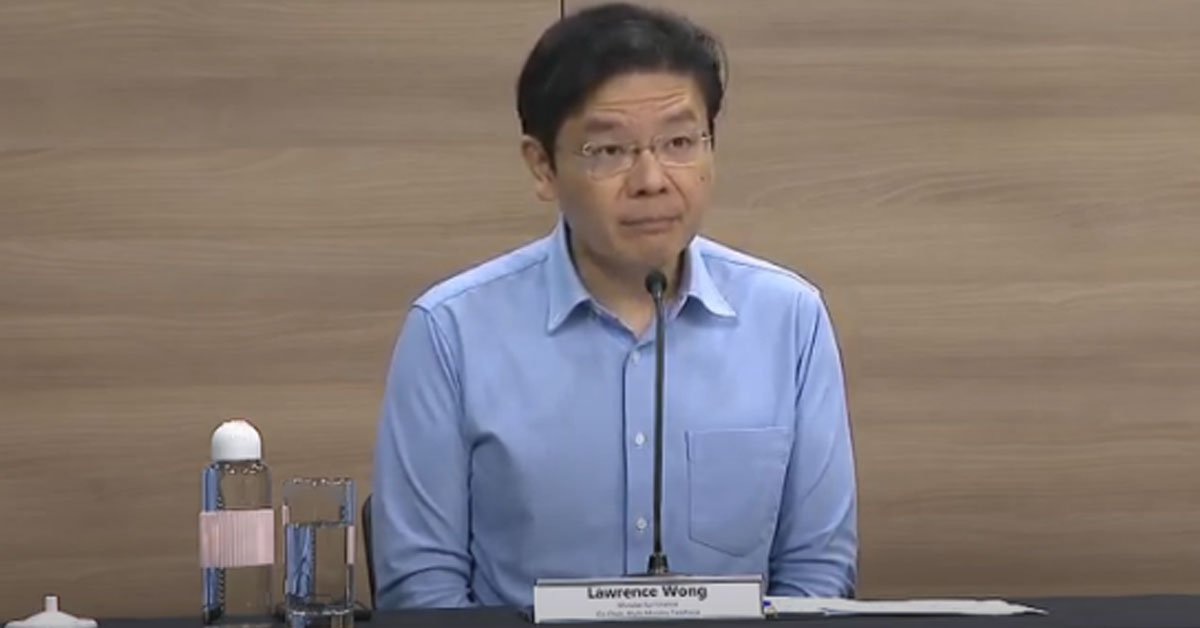

Finance Minister: GST Hike Will Still Take Place Between 2022 to 2025

There’s no avoiding it; we’re on course for a head-on collision with the GST hike sometime in the next four years.

Speaking during a debate on the Income Tax (Amendment) Bill, Finance Minister Lawrence Wong said the government will go ahead with its plans to raise the GST between 2022 and 2025.

The need to raise Government revenue, Mr Wong explained, stems from increasing expenditure in areas such as healthcare and social spending.

As for the exact timing of the hike, that will depend on a number of factors, including the prevailing economic conditions and country’s fiscal needs.

To know more about GST, watch this video to the end:

60% of GST Borne By Foreigners & Top Local Earners

A year ago, when the GST hike was being debated in Parliament, Non-Constituency MP Leong Mun Wai suggested doing away with it altogether.

In response, then Finance Minister DPM Heng noted that over 60% of the net GST borne by all individuals and households in the country is from foreigners residing in Singapore, tourists, and the top 20% of households.

Deferring the hike indefinitely means the government will lose the additional revenue from these groups which can be used to improve the lives of Singaporeans, he added.

A Wealth Tax?

During the debate, Workers’ Party MP Louis Chua brought up the possibility of a wealth tax, as well as more financial aid for small and medium-sized enterprises (SME).

For the unacquainted, a wealth tax is a type of tax based on the market value of assets owned by a taxpayer.

In recent years, an increasing number of calls for a wealth tax has been made not just in Singapore, but all over the world.

Mr Wong responded by saying these proposals are in line with the government’s intentions to address wealth inequality and support SMEs.

“But to address wealth inequalities, what exactly do we do, what sort of measures do we put in place – that’s something that we will have to study carefully,” he added.

The Finance Minister said that Singapore already has a form of wealth tax – the tax levied on private residential properties, the amount of which depends on the property’s annual value.

He added that the government is considering all options to address these issues, but said he didn’t want to “pre-empt” next year’s Budget.

Read Also:

- Record 3,486 COVID-19 Cases Reported on 5 Oct with 9 New Deaths

- Netizens Debated About KSL Mall’s Strategy After Someone Posted How Empty It is Now

Featured Image: YouTube (CNA)