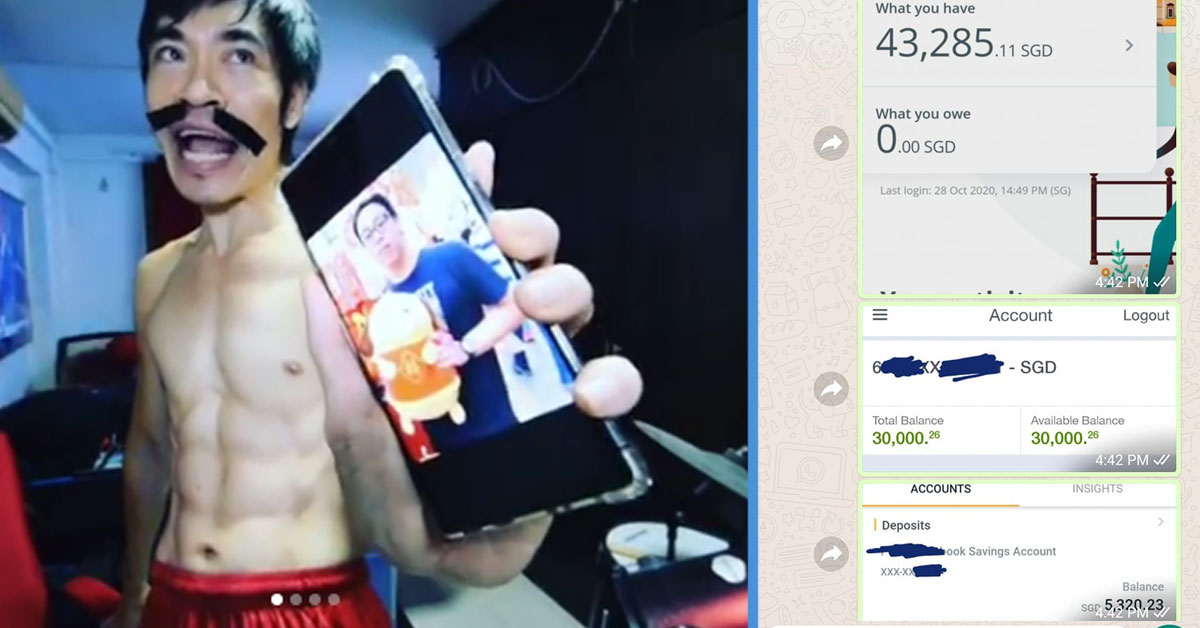

The pandemic may have proven to be a real financial shocker all around the world, but it appears that it has done naught to the HDB resale market in Singapore.

There were 82 million-dollar flat transactions last year, compared with 64 in 2019.

This is despite the Covid-19 virus that was rampant for most part of the year, and considerably higher HDB resale prices in 2020.

As a Wise Old Man would probably put it: “We all need a roof over our heads, no matter the circumstances, prices and most notably, the circumstances.”

In 2020, There Were 82 HDB Flats That Were Resold For Over $1 Million

There were 82 million-dollar flat transactions last year – which constitute around 0.35 per cent of the total HDB resale flats retailed in 2020.

This is in spite of the total price rise in 2020 – which was calculated to be 6.4 per cent.

In comparison, 2019 reported a mere 0.3 per cent increase.

The phenomenon has naturally led analysts to appraise the tenacity of the HDB resale business.

“The performance of the HDB resale prices and transaction volume illustrates that the adverse impact of Covid-19 and economic recession is like water off a duck’s back,” said ERA Realty head of research and consultancy Nicholas Mak.

Lest you’re unaware, the phrase “water off a duck’s back” refers to the distinct lack of effect.

It could also, of course, refer to water rolling off an actual duck’s back, but we highly doubt that Mr Mak has tried doing that before.

The fourth quarter of 2020, in particular, was astounding. According to earlier HDB flash estimates, resale prices soared 2.9 per cent in the fourth quarter alone.

This proved to be the largest quarterly increase in over nine years.

Sold At Higher Prices

There is always demand for newer flats, and it’s no different in the pandemic season.

“The resale transactions of HDB flats that recently completed the five-year minimum occupation period continue to exert their influence on the HDB price index,” said Mr Mak.

“These newer flats are usually sold at higher prices than older flats in the same vicinity.”

Advertisements

In fact, the pandemic may have actually contributed to the resale market.

“Before Covid-19… applicants for HDB Build-To-Order (BTO) flats may have had to wait about three years to get the keys to their new flats.

“The pandemic led to bottlenecks and delays in the construction of many public housing projects. As a result, some potential HDB BTO applicants are turning to the resale market for their home purchases.”

So yes: people can’t wait longer for their flats so they buy resale flats instead, which increases the demand and therefore the prices.

Notable Places

Apparently, some places that have overseen high-priced transactions include Dawson, Punggol and Boon Tiong Road.

In total, 23,427 units were resold in 2020 – 4.3 per cent higher than in 2019.

Advertisements

The highest transacted price (for a resale flat) in December 2020 was $1,218,888 – achieved by a five-room unit at Natura Loft in Bishan.

According to experts, the HDB resale market is expected to continue its hot streak this year.

However…

There’ll be slight changes to prime areas and the benefits they incur.

According to Minister for National Development Desmond Lee, the government will be looking at a two-pronged approach to regulating HDB flats in prime areas such as the Greater Southern Waterfront (GSW).

The reason is pretty simple; the government doesn’t want the rich to monopolise all the prime locations in Singapore.

Advertisements

After all, when a homeowner buys an HDB flat at subsidised prices, he is able to resell it 5 years later at a higher price due to the location.

Repeat this a few times and soon, only people above a certain financial capability will be able to afford to live in the area.

Public housing, he pointed out, is for all citizens, bringing together people from “different industries, demographics, and races”.

As such, HDB flats being resold at $1 million may very well soon be a thing of the past.

Featured Image: happycreator / Shutterstock.com

Advertisements