Browse any financial site right now and you’d likely find yourself reading about the collapse of FTX.

After all, the FTX crash has sent shockwaves around the world. The meteor has hit many parties, and we’re no different.

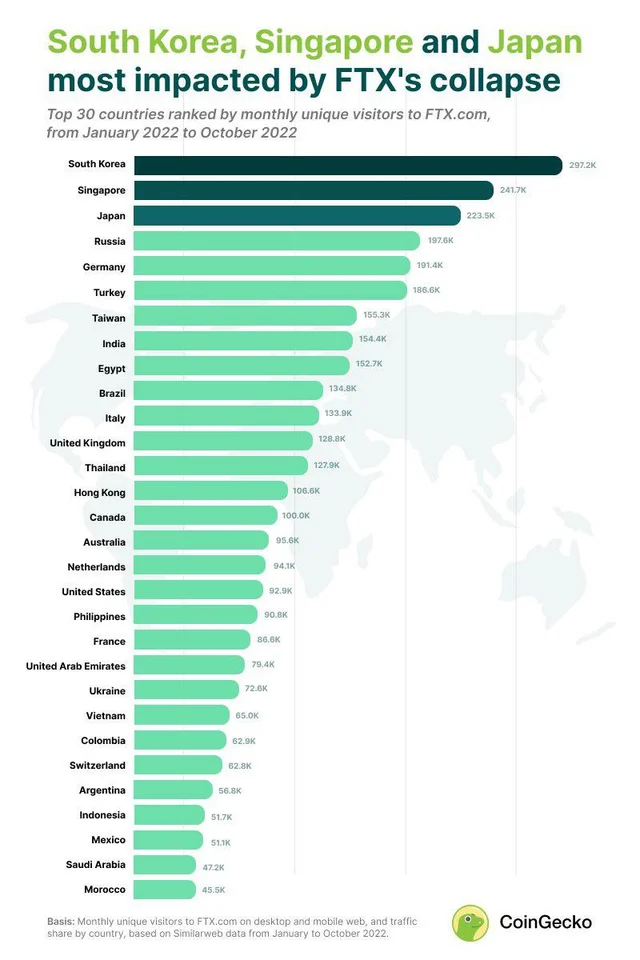

Singapore is 2nd most impacted by FTX collapse

In a survey done by CoinGecko, it revealed that Singapore had the second highest number of monthly average unique users on FTX.com. It was behind South Korea, which had 297,229 unique monthly users.

The 241,675 Singaporean users make up 5% of the traffic on FTX.com.

How did so many Singaporeans find their way to FTX in the first place?

In February 2022, the world’s largest crypto exchange Binance pulled its Singapore branch out of operation.

In September 2021, Monetary Authority of Singapore (MAS) added Binance.com to its Investor Alert List (IAL), and under increasingly stringent regulations, Binance.sg closed by 12 February 2022.

With nowhere else to head, Singaporeans resorted to using FTX.com. FTX’s monopoly on Singapore’s market helped it rack up many Singaporean users.

In the end, when FTX collapsed, Singapore was badly affected.

Pointing Fingers

Many faulted MAS for the downfall.

For context, MAS is responsible for regulating and licensing crypto operators.

People were unhappy that MAS faulted Binance but let FTX continue to serve the users in the nation.

MAS responded by saying that: “It would not be meaningful for MAS to list all unlicensed entities on the IAL. MAS did not have cause to list FTX on the same basis as Binance.”

MAS only lists entities that may be “wrongly perceived” as being locally regulated on the IAL, which was the case for Binance.

FTX Crash

FTX is a cryptocurrency exchange system which promotes transaction of digital currencies.

In this market, users are able to link their crypto wallets and engage into digital transactions. They can place trades, enter into contracts, as well as buy/sell NFTs.

Started by Sam Bankman-Fried and Gary Wang in 2019, this platform originally saw hypergrowth. However, as it increased in popularity, it did not have enough to supply customer demands.

Many were sceptical about the solvency of the company (the ability to meet long-term debts and financial obligations) and worried that they stood to lose all their money. As such, they withdrew from the market.

This led to the collapse of the FTX empire, with its share price pummelling.

Featured Image: Shutterstock